Sell Call (Short Call) - An Option Trading Strategy

- Kajal Deshmukh

- Jul 5, 2023

- 2 min read

The short call involves the selling of the call option contracts. It is a single-leg strategy. As we always start with understanding the market outlook, advantages, disadvantages, and how to enter and exit, we shall continue the same pattern for your ease.

Market outlook:

The market outlook tells us about the market condition and the best time to apply this strategy. When the trader is firm that the market of the underlying asset will be bearish, at that time, they can use this strategy. This strategy has unlimited risk and should be applied in absolute need and when you are cent percent confirm about the market's bearishness.

How to enter the short call strategy?

In order to enter the short call strategy, you need to sell one call option contract against the premium.

Sell one Call option.

Highest profit on this strategy:

We are selling the call option against the small amount of premium. Thus, the maximum profit in this strategy will be limited only to the premium received. There is no additional income/gain or profit. Another scenario where traders can profit is - In case the value of the underlying asset is less than the strike price, traders may receive some profit.

Highest loss on the strategy:

The loss or the risk majorly depends on the underlying asset's price movement, in other words, the underlying asset's volatility. The maximum loss is unlimited in the strategy. Also, traders face a loss when the underlying asset's value exceeds the strike price and premium received combined. In the third scenario, traders can face the loss as; Loss = underlying asset's price - strike price of the call option contract - premium received. So, we have seen that the profit potential is very low, and the risk involved is very high. Thus, you should be very careful while implementing this strategy.

Why enter this strategy? Are there any advantages to entering into this strategy?

The main advantage of implementing this strategy is to profit from the price downfall. We have seen that the options are the only instruments that allow you to profit from any market scenario.

Thus, when the market is bearish, meaning when the price of the underlying asset is falling, and you want to benefit from it, you may apply this strategy.

What are the disadvantages of the short-call option strategy?

As we saw that the risk profile of this strategy is very high. The risk involved is very high. The risk is unlimited as you try to sell the option contract without holding the underlying asset. Thus, if your prediction proves to be wrong and the market does not perform according to what you have predicted, settling the contract will be a very tough task.

Illustration

Eg. Nifty is currently trading @ 5500. Investor is expecting the markets to fall down drastically from these levels. So by selling a Call Option of Nifty having Strike 5500@ premium 50, the investor can get an inflow of ₹ 50 and benefit if Nifty stays below 5550.

Strategy | Stock/Index | Type | Strike | Premium Inflow |

Sell Call | NIFTY (Lot size 50) | Sell Call | 5500 | 50 |

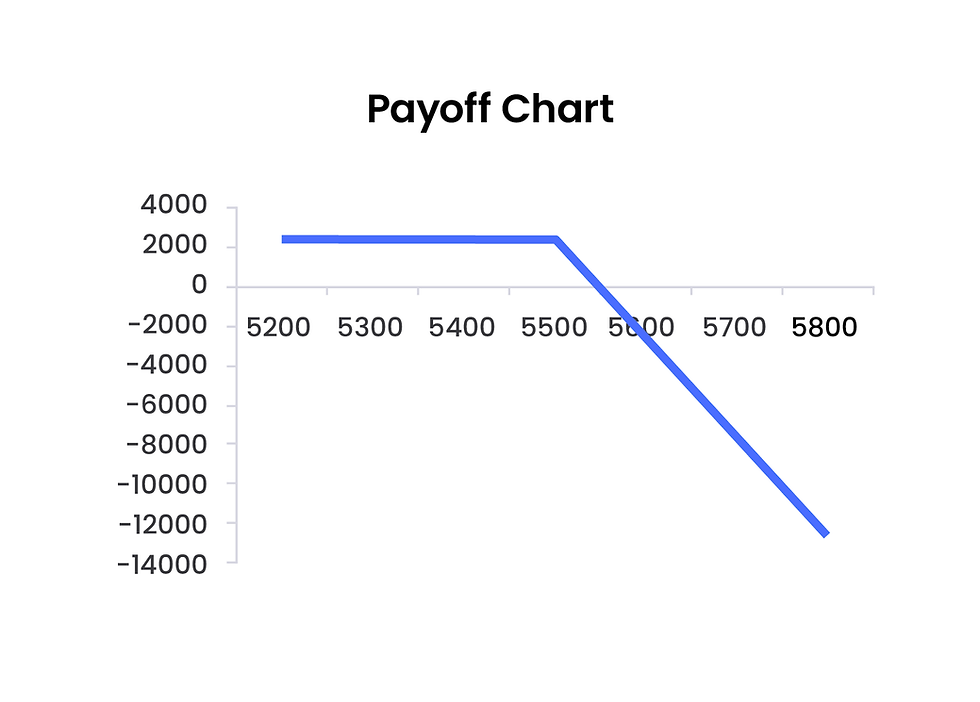

The Payoff Schedule and Chart for the above is shown alongside.

Payoff Schedule

NIFTY @Expiry | Net Payoff (Rs.) |

5200 | 2500 |

5300 | 2500 |

5400 | 2500 |

5500 | 2500 |

5550 | 0 |

5600 | -2500 |

5700 | -7500 |

5800 | -12500 |

5900 | -17500 |

In the above chart, the breakeven happens the moment Nifty crosses 5550 and risk is unlimited . It is important to note that irrespective of how much the market falls, the reward is limited to 2500 only.